Profile/Philosophy

FPM Frankfurt Performance Management AG (FPM AG) is a privately-owned asset management company based in Frankfurt am Main.

We are

- specialized – in value investing

- focused – on stock picking in German equities

- target driven – oriented to long-term performance alongside limited risk

- institutionally and intellectually independent

- experienced – we were founded in 2000

- responsible – for 2 mutual funds and 1 special mandate

We invest

- consistently according to a disciplined approach – bottom-up, primary analysis prior to secondary research

- regardless of size, indices or sectors

- transparently and comprehensibly for our investors

Expertise in German equities

At the heart of our philosophy is the value approach.

For our investors we look for attractive undervalued companies with a promising business model whose management, competitive advantages and market position we can assess properly.

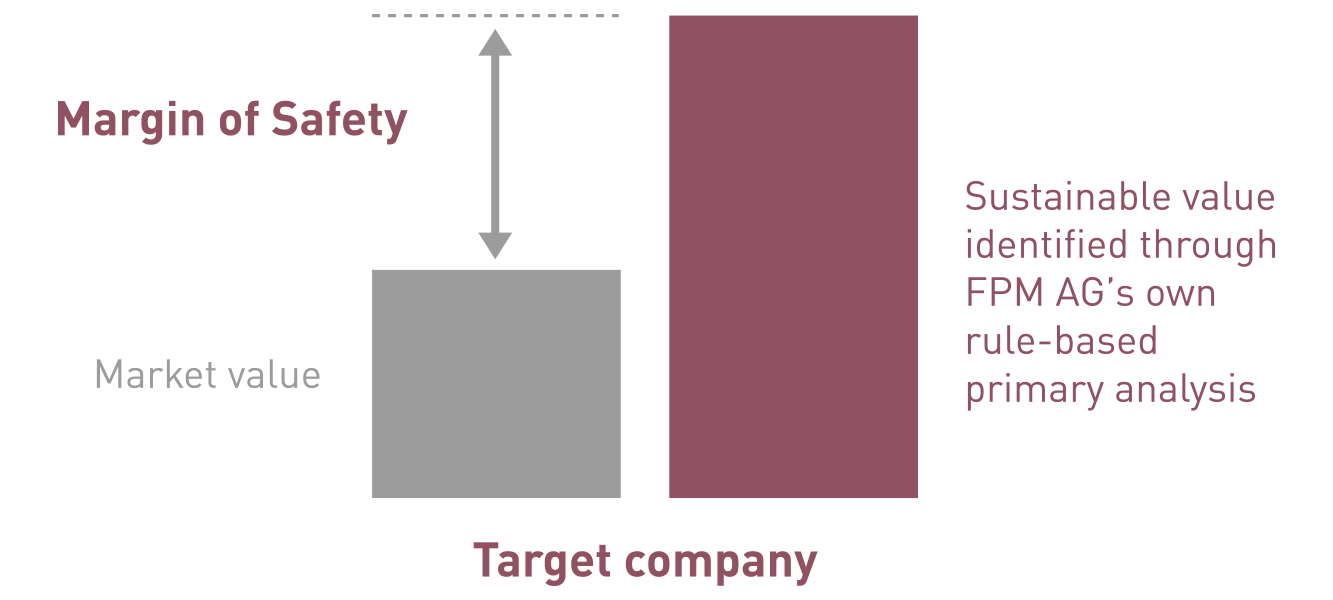

The valuation of an investment dominates our approach: only undervaluation provides a buffer against overly optimistic expectations. This is known as the “margin of safety”.

Even the best business model and glittering future prospects are of no use if they are already reflected in the price of a company. That’s because even comparatively minor shortcomings can then lead to significant losses.

Our objective is easy to formulate, yet anything but easy to achieve: at the time of purchase, every investment should enable a performance of at least 10 % over the long term.

That means we have to understand more than others. Here too, the key to success is focus: we concentrate on the German equity market – regardless of indices.

We know this investment universe intimately: we deal with our target companies continuously, we follow them over a long period of time and we cultivate regular contact with the respective management teams.

That is how – along with the home advantage of sharing the same language, knowledge of the general legal and political situation and a high frequency of contact with the decision-makers – we obtain the information that forms the basis for what we and our investors want: correct, focused and sustainable investment decisions.

We ignore index weightings and the latest trends and we don’t let ourselves be distracted by noise on the capital markets.

You see, what our investors appreciate is that our independence enables us to reach decisions without conflicts of interest and against the general consensus.